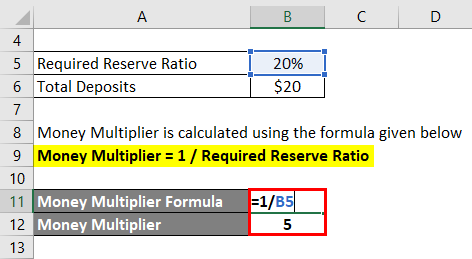

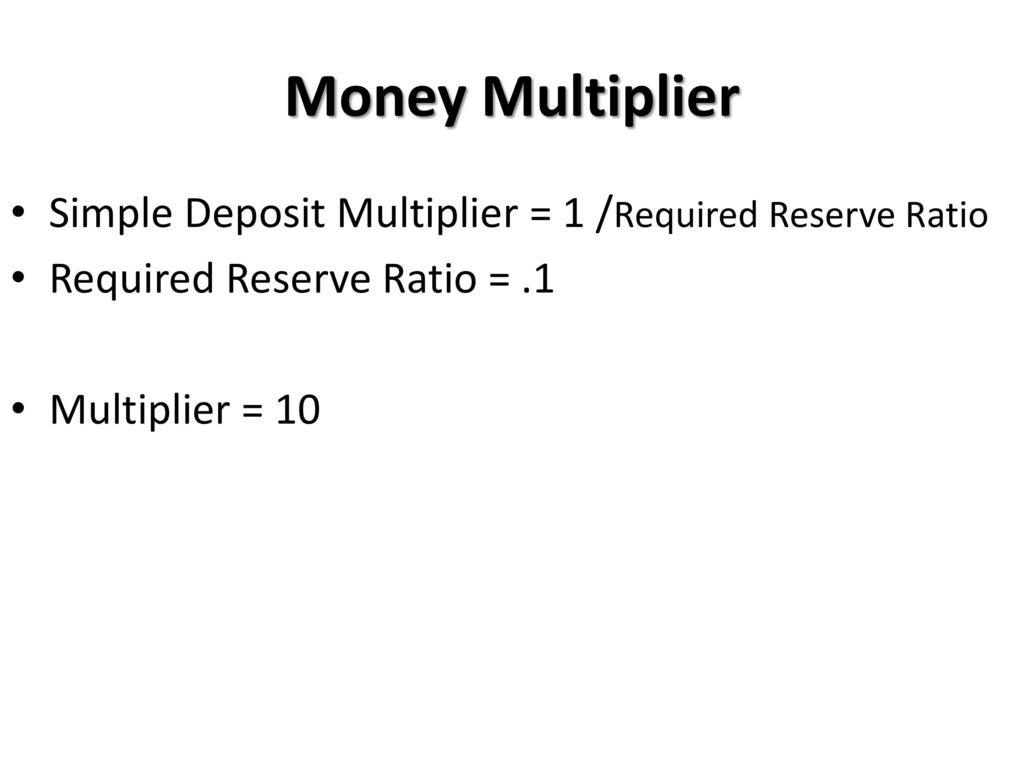

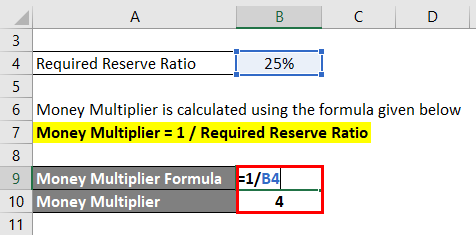

If The Required Reserve Ratio Is 20%, What Is The Simple Deposit Multiplier? | What is the necessary increase in government spending, if the desired increase to gdp is 100 billion and the government spending multiplier is 3? The deposit multiplier, or simple deposit multiplier, refers to the amount of cash that a bank must keep for example, if the bank has a 20% reserve ratio, then the deposit multiplier is 5, meaning a bank's total amount of checkable deposits cannot exceed an amount equal to five times its reserves. The reserve ratio refers to the percentage of deposits that the bank is required to keep in order to efficiently handle customer demands for withdrawals. However, in the real world, there are many reasons why the. The reserve ratio is the % of deposits that banks keep in liquid reserves. Part of a series on financial services. What is the simple money (deposit) multiplier? A bank currently has $100 million checkable deposits, $4 million in reserves, and $8 million in securities. The deposit multiplier, or simple deposit multiplier, refers to the amount of cash that a bank must keep for example, if the bank has a 20% reserve ratio, then the deposit multiplier is 5, meaning a bank's total amount of checkable deposits cannot exceed an amount equal to five times its reserves. While interest is earned, it is different from profit in that it is received by a lender as opposed to the owner of. Reduced loan capacity results in a the size of the multiplier effect depends on the percentage of deposits that banks are required to hold on reserves. Treasury securities by the federal reserve: Part of a series on financial services. .is 20%, what is the money multiplier if the banks do not keep excess reserves and recipients of bank loans deposit the entire amount? Round to two decimal places. In the simple deposit expansion model, if the required reserve ratio is 20 percent and the fed increases reserves by $100, checkable deposits can potentially expand by. In case of a financial emergency faced by a bank, central bank is the only institution that can come to the rescue of the concerned bank. What is the money multiplier in this economy? Money multiplier = 1/0.05 = 20. .required reserve ratio is 15 percent, currency in circulation is $400 billion, checkable deposits deposits are $1000 billion, and excess reserves total $1 billion, then the m1 money multiplier is a) 2.5. If the required reserve ratio were changed to 5% and first charter bank continues to hold $1,200,000 in reserves, its excess reserves will be a) $600,000. Smith first deposits that $100 in cash at first superior bank, that creates a $100 increase demand deposit here on first superior bank's balance sheet. Technically, the reserve ratio can also take the form of a required reserve ratio, or the fraction of deposits that a bank is required to keep on hand as suppose the required reserve ratio is 0.2. Reduced loan capacity results in a the size of the multiplier effect depends on the percentage of deposits that banks are required to hold on reserves. If the required reserve ratio were changed to 5% and first charter bank continues to hold $1,200,000 in reserves, its excess reserves will be a) $600,000. If the federal reserve sets the minimum reserve ratio for private banks at 25%, then the money multiplier is 3. In the simple deposit expansion model, if the required reserve ratio is 20 percent and the fed increases reserves by $100, checkable deposits can potentially expand by. Find an equation of an ellipse if the center is at the origin, the length of the major axis is 20. If the required reserve ratio is 20 percent, the simple deposit multiplier is a) 5.0. What is the necessary increase in government spending, if the desired increase to gdp is 100 billion and the government spending multiplier is 3? So if the required reserve ratio is 20%, the deposit multiplier ratio is 80%. A bank currently has $100 million checkable deposits, $4 million in reserves, and $8 million in securities. If the required reserve ratio were changed to 5% and first charter bank continues to hold $1,200,000 in reserves, its excess reserves will be a) $600,000. Find an equation of an ellipse if the center is at the origin, the length of the major axis is 20. .required reserve ratio is 15 percent, currency in circulation is $400 billion, checkable deposits deposits are $1000 billion, and excess reserves total $1 billion, then the m1 money multiplier is a) 2.5. The deposit multiplier, or simple deposit multiplier, refers to the amount of cash that a bank must keep for example, if the bank has a 20% reserve ratio, then the deposit multiplier is 5, meaning a bank's total amount of checkable deposits cannot exceed an amount equal to five times its reserves. .is 20%, what is the money multiplier if the banks do not keep excess reserves and recipients of bank loans deposit the entire amount? Assuming the only other thing tazian banks have on their balance sheets is loans, what is the value of existing. It is inversely related to legal reserve ratio. Macroeconomics over the role and effects of government 19 elasticity 20 consumer choice: The fed lowers the required reserve ratio from 15. Technically, the reserve ratio can also take the form of a required reserve ratio, or the fraction of deposits that a bank is required to keep on hand as suppose the required reserve ratio is 0.2. Required reserve ratio is the fraction of deposits which a bank is required to hold in hand. A bank currently has $100 million checkable deposits, $4 million in reserves, and $8 million in securities. In the simple deposit expansion model, if the required reserve ratio is 20 percent and the fed increases reserves by $100, checkable deposits can potentially expand by. The concept of interest is the backbone behind most financial instruments in the world. .is 20%, what is the money multiplier if the banks do not keep excess reserves and recipients of bank loans deposit the entire amount? If the required reserve ratio were changed to 5% and first charter bank continues to hold $1,200,000 in reserves, its excess reserves will be a) $600,000. A bank currently has $100 million checkable deposits, $4 million in reserves, and $8 million in securities. The regulatory reserve requirement set by the u.s. .required reserve ratio is 15 percent, currency in circulation is $400 billion, checkable deposits deposits are $1000 billion, and excess reserves total $1 billion, then the m1 money multiplier is a) 2.5. In other words, it is money used. In case of a financial emergency faced by a bank, central bank is the only institution that can come to the rescue of the concerned bank. Money multiplier= 1/required reserve ratio. This is the amount of money all banks must keep on hand in their reserves. Usually, when a person deposits money in the bank. .deposit are rs 100, what is the value of multiplier and tota l lending by the bank system ? So if the required reserve ratio is 20%, the deposit multiplier ratio is 80%. Simple deposit multiplier, if the required reserve.

If The Required Reserve Ratio Is 20%, What Is The Simple Deposit Multiplier?: The purchase of existing u.s.

Source: If The Required Reserve Ratio Is 20%, What Is The Simple Deposit Multiplier?

0 comments:

Post a Comment